The slow unbundling of European banks

One of the many paradoxes of consumers regarding innovation is how slow they are to react to what impacts them the most. The more critical a product is to them, the slower they seem to be willing to shift to new, better solutions. There's undoubtedly a "devil you know" mentality at play and risk aversion regarding potential backlash if the new solution eventually fails, but still.

It took Europeans many years to slowly accept pure online banks as regular actors in the market, and yet we are still unable to use them as our main bank most of the time (mortgages are still tied up with regular banks). The somehow optimistic view we had about ten years ago about the possible unbundling of the desperately underperforming retail banking system never materialized at scale in the market:

In Europe, the regulatory environment is arguably more friendly for new entrants than in the US, and there are startups successfully attacking the banks at scale in lending (Funding Circle, Pret d'Union, Ratesetter, Zopa) and international FX transfers (TransferWise, World Remit). Other areas that provide sizeable profits to the banks are in the early phase of startup development, such as equity financing (Angellist, Crowdcube, OurCrowd,Seedrs), mortgages, payments (Adyen, iZettle, SumUp, Tipalti), personal financial management (e.g. Tink), pension and savings (e.g. Nutmeg,SavingGlobal), working capital finance (e.g. MarketInvoice, Novicap), and even core banking (current accounts e.g. Number26, Holvi). - Unbundling of the Banks in Europe, 2015 - Toby Coppel

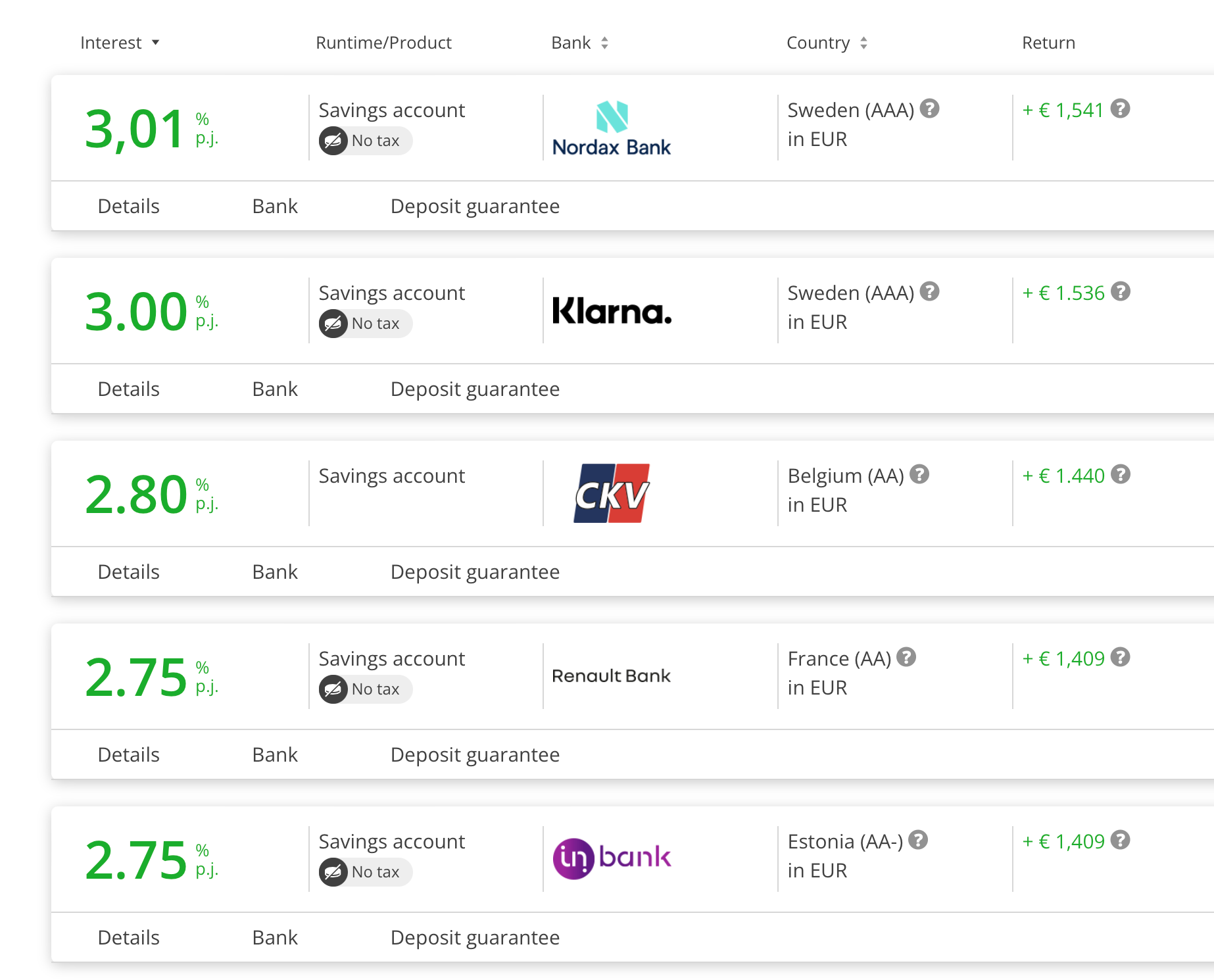

Some are still trying to get the unbundling going, though. In the context of increased interest rates and looming inflation, actors like Raisin are starting to offer comparisons on deposit or savings accounts in various banks and allow you to spread your money to various countries:

But this is still quite an 'expert consumer' market with much psychological friction around trust and reliability. Who's really managing his free personal cash flow on a weekly basis, especially when you may have trouble making ends meet?

As I was recently writing about strategic moats and their classification, it's striking that the incumbent banking industry is still quietly sitting behind the simplest of all moats: psychological switching costs. No doubt, the proverbial Homo economicus (a purely rational consumer seeking to maximize return on investment and minimize efforts) doesn't exist.

As no system lives in perpetuity, I'm curious about what will eventually end the centuries-old current banking system. Who will finally be the first operator to crack the moat and flood the zone? It doesn't have to be a startup. Apple tried timidly and has not been doing much since then...

Or maybe unbundling the banking system should be done overtly by actors we don't consider as banks?