Is Intel dead? (yes)

Intel's downfall has been ongoing for decades now. While they barreled out of the seventies to the eighties as a juggernaut weaponizing the emerging desktop computer segment with Microsoft, they entirely missed the mobile market twenty years later. While still pushing for more powerful chips, the industry was now seeking energy-efficient devices (a story about Koomey's law winning over Moore's). In a market where building a factory is a matter of dozens of billions of dollars, you need to get where's the market is going for the next ten years very, very right.

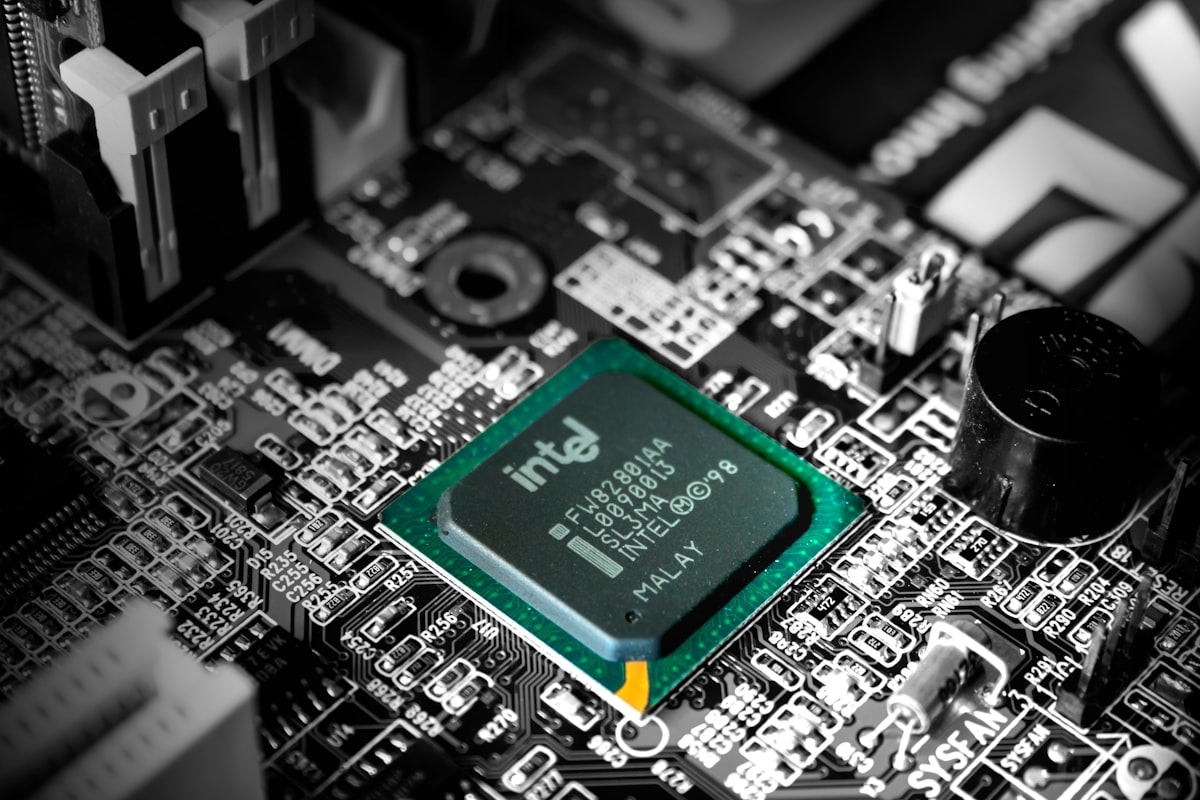

Since then, Intel missed quite a few other boats, but worse, they're missing most of their tech roadmap goals as well:

- In 2014, Intel's plan on smaller 450 mm wafers to increase cost-efficiency was "delayed" indefinitely.

- Samsung beat them on using extreme ultraviolet light to get to 10-nanometer chips in 2018.

- For years, Nvidia has been running circles around them on GPUs and AI-dedicated microchips.

I stop here; there are tons of articles detailing this tech giant's slow and painful death. Intel's situation is really dire, with a 2021 reported net income of negative $19.87b over $79b in revenues.

Their last trick is to come back in the GPU game with a new technology that should be on the market for Q2, 2022. They are already late, but they should get there. They have also unveiled what is, in my opinion, a very ill-named project:

“Project Endgame,” will allow customers to stream access Intel’s graphics cards for an “always-accessible, low-latency computing experience.” The exact mechanisms here aren’t totally clear, but it sounds like Intel will allow customers to rent GPUs in the cloud, or even a full-fledged front-end gaming service like Nvidia’s GeForce Now subscription.

Yes, the oldest financial trick in the bag since 2010: subscription revenues!

Now, you probably think I will point out the innovator's dilemma or a failing corporate culture. Yes, but more importantly, it's a sunk costs story here. Companies with a business model depending on large-scale investments need to get the market right over ten to twenty years. And as soon as they finance a ten or thirty billion project, they get over-committed to their projections. These stories happen in other markets such as energy or transportation (ask Boeing).

As for Intel, we will know if Intel has died or is still alive by the end of the year. It's still a big Schrödinger's box, but it doesn't smell good.