🟢 Can coopetition work as a catch-up strategy for European automakers?

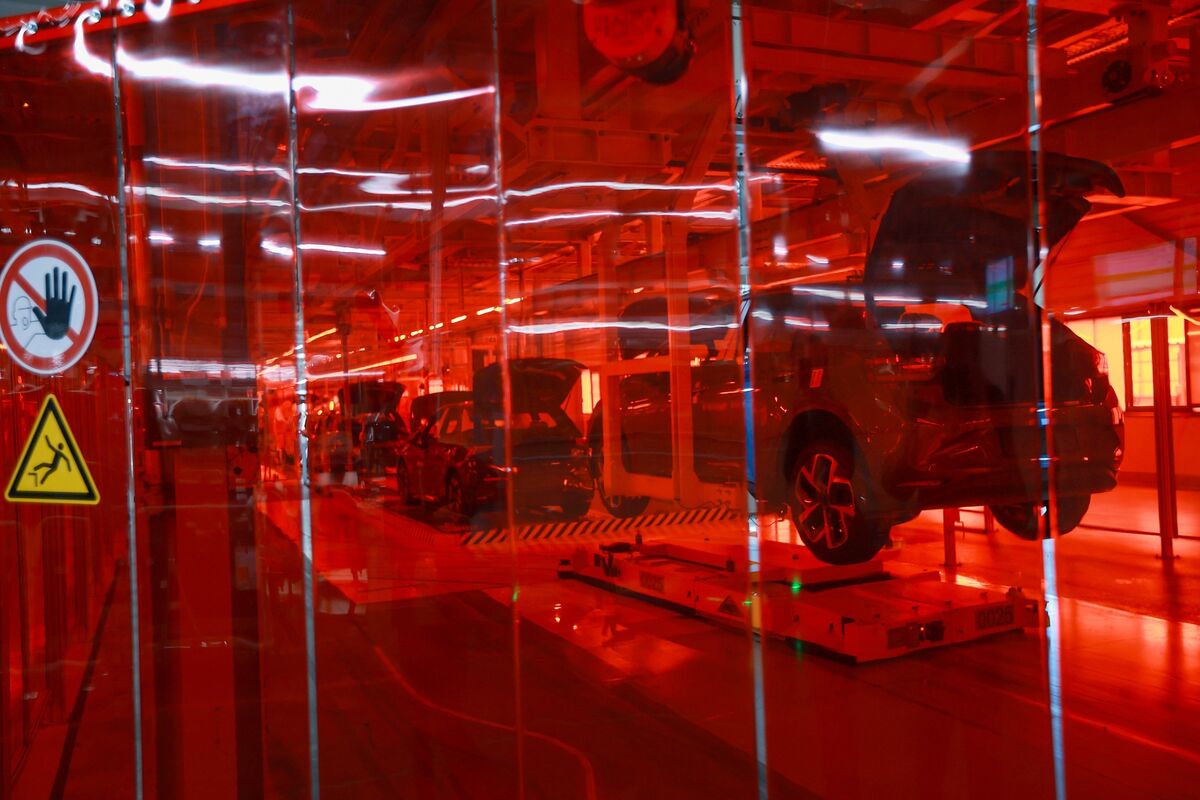

European automakers, including industry giants like Volkswagen, Renault, and Stellantis, are embarking on what is somehow an unconventional strategy for them: competition. After ignoring China's electric vehicles (EVs) and Tesla for a decade and a half, their back-to-the-wall, the only way out is now ramping up a collaborative effort with sworn competitors to produce affordable EVs of their own.

Coopetition is all about dealing with discomfort. Knowing you won't survive on your own, you pool effort with a few others, trying to get out of a strategic bind together but not knowing who among your competitors might get the best deal out of it. And maybe it won't be you.

Most of the time, coopetition strategy is not a visionary take on future events in the market but a response to the evolving landscape where a sense of urgency is growing. Carlos Tavares, the CEO of Stellantis NV, emphasized many times that European carmakers are still unprepared to face the market going away from gas and diesel engines. And while Tesla has been a real threat to the high-end sector for a while now, it's really the advancements made by Chinese state-supported manufacturers, who prepare their entry into the European market with often superior and more affordable electric models that was the last straw.

This push, compounded with European carmakers' realization that switching technologies was met with unexpected challenges such as glitchy software, high operating expenses, and maintenance complexities, has intensified the sense of urgency.